Had the pleasure of sitting down with AAR Magazine this month to discuss VA Loans:

|

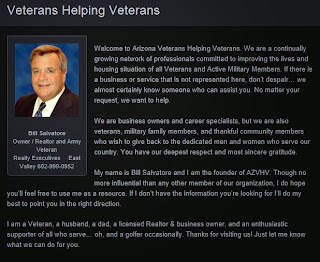

| Bill Salvatore with AZVHV / Arizona Veterans Helping Veterans / www.yourValleyProperty.com |

1. What are some common misconceptions that REALTORS® have about working with clients who qualify for VA loans?

That they are difficult loans to do, they really are not if you know what you are doing. Also sellers are mis-lead by allot of agents into not accepting VA contracts because of potential issues with VA appraisers and fees the veteran cannot pay (not allowed to pay).

- VA appraisals have a reputation of taking longer but if you’re working with a

Knowledgeable lender they’ll be right on top of it, and order the appraisal a little earlier. The property must also appraise at full value according to the contract due to 100% financing.

2. What are some of the benefits to REALTORS® who work with Veteran clients?

Just knowing they need no down payment, often a major stumbling block to anyone buying a home. In my experience, Veterans seem to have a better understanding of and more patience with the process. (maybe a residual of military life)

3. How do you go about finding out if a client qualifies for a VA loan? What steps do you follow?

The lender will pull their credit to make sure they have min. 620 credit score. The veteran will need to produce their DD214 then they or the lender can go to the VA website and order a Certificate of Eligibility.

4. What types of resources help you when working with Veterans?

Definitely the VA website. Everything we need to know is there.

5. Do you find that clients who utilize VA loans have differing needs than those of a traditional client? Why or why not?

Not necessarily different needs, I guess just different perks. 100% financing is a huge benefit, plus with seller contributions towards closing cost they can buy a home with little/no money out of pocket. In a “seller’s market” this is a bit more of a challenge…

6. What’s the biggest challenge a REALTOR® may encounter when working with a client who is using a VA Loan?

The biggest challenge to a Realtor might be knowing how to write the contract. For instance,

you must have a clear termite report and the lender will require proof, a copy of the report.

What is the biggest reward you get out of working with Veterans?

There are both business and personal rewards.

a. Knowing that you helped a veteran get a home especially when they didn’t believe they would ever be able to. It is a powerful feeling.